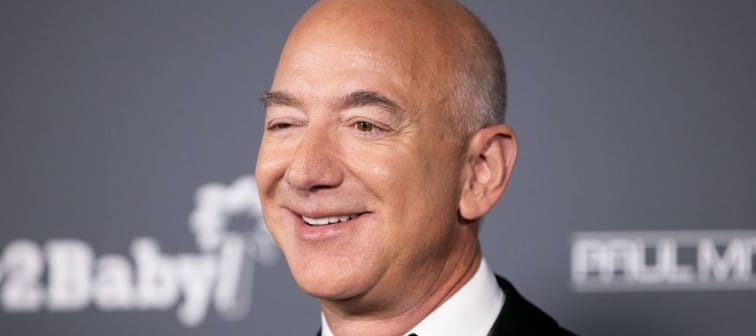

Selling Amazon shares

Since the late 1990s, Bezos has sold billions of dollars worth of Amazon shares to fund his philanthropy, other business projects and his billionaire lifestyle.

But in 2022, he hit pause on his stock sales when Washington state imposed a new 7% capital gains tax on sales of stocks or bonds of more than $250,000.

After moving to Florida, Bezos took his foot off the brake. He recently sold around 12 million Amazon shares for roughly $2 billion, according to a company filing on Feb. 9.

As a resident of the Sunshine State — which does not tax on capital gains — Bezos managed to save around $140 million in taxes he would have had to pay to Washington state for the same transaction.

He also announced a pre-scheduled stock-selling plan to unload 50 million shares before Jan. 31, 2025, which would be worth nearly $8.5 billion today.

With the Florida advantage, he will save around $593 million on capital gains taxes — and that’s if Amazon shares remain flat (bear in mind that the stock has jumped more than 13% so far this year).

It’s important to note that both states — Washington and Florida — have no state income tax and their real property tax rates both hover around 1%. The real game-changer, for Bezos at least, seems to be Washington’s relatively new capital gains tax, which would see him hand billions over to the government. Here are three ways you can save some of your hard-earned cash from the tax man.

Meet Your Retirement Goals Effortlessly

The road to retirement may seem long, but with WiserAdvisor, you can find a trusted partner to guide you every step of the way

WiserAdvisor matches you with vetted financial advisors that offer personalized advice to help you to make the right choices, invest wisely, and secure the retirement you've always dreamed of. Start planning early, and get your retirement mapped out today.

Get StartedFollow Bezos’ move

If your tax bill fills you with financial dread year after year, then maybe you should consider a Bezos-style move to a different, more tax-friendly state. That's what financial gurus like Grant Cardone have been recommending.

They often cite recent migration trends in their arguments. Texas and Florida experienced the highest population growth in 2023, according to Census Bureau data, with gains of 473,453 people and 365,205 people, respectively. Both states have no personal income tax — which could help you save a good chunk of your pay each year.

If you’re considering moving states because you’re tired of paying high income taxes, it’s important to remember that personal income tax rates only tell part of the tax story.

You have to consider each individual state’s personal income tax brackets and the available deductions, exemptions and credits. Also remember that property and sales taxes can impact a state’s affordability.

For example, while Texas has no state income tax, it has one of the highest effective property tax rates in the country, at 1.68%. In a similar vein, zero-individual income tax Tennessee has the highest sales tax in the country, at 9.548%.

If you’re considering making a move, it may be worth consulting with a tax professional to get a clear picture of your total tax liabilities before packing up your life.

There's also other factors to consider. The average cost of homeowners insurance in Florida is three times more than the national average and has increased 102% in the last three years, per the Insurance Information Institute.

Invest in tax-advantaged accounts

If you’d rather stay put where you live, one of the easiest ways to hold some money back from the IRS is to invest in tax-advantaged vehicles like a 401(k) account or an individual retirement account (IRA).

With a 401(k) retirement savings plan, you can steer a portion of your pay into an account — up to $23,000 in 2024 — which you can then invest to grow your money. You won’t pay tax on those contributions until you withdraw your funds during retirement, and by then you should be in a lower income-tax bracket.

If you don’t have access to a 401(k), you might consider opening a traditional IRA, where you can contribute pretax income — up to $7,000 (for those under age 50) and $8,000 (for those age 50 or older) in an IRA in 2024 — and grow it tax-free until you make withdrawals in retirement.

Another option is a Roth IRA, where your contributions are taxed upfront so that your withdrawals are tax-free in retirement. This, of course, is less helpful for reducing your upcoming tax liability — but Roth IRAs can offer some advantages and flexibility compared to traditional IRAs.

This 2 Minute Move Could Knock $500/Year off Your Car Insurance in 2024

Saving money on car insurance with Bestmoney is a simple way to reduce your expenses. You’ll often get the same, or even better, insurance for less than what you’re paying right now.

There’s no reason not to at least try this free service. Check out BestMoney today, and take a turn in the right direction.

Get StartedLower your taxable income

You can reduce the amount of money you owe to the IRS through effective usage of tax credit and tax deductions. If you don't have an accountant, tax prep softwares can search through credits and deductions for you.

Tax credits are highly desirable because they directly reduce your tax bill. Some popular examples include: the child tax credit (CTC), the electric vehicle (EV) tax credit and the earned income tax credit (EITC).

All tax credits have different thresholds for eligibility and are often based partly on your income. It is important to monitor the IRS tax credit requirements if your income changes over time.

Tax deductions are slightly different in that they lower your taxable income. When filing your taxes, you’re given the choice to either take the standard deduction or itemize deductions.

For tax-year 2024, the standard deduction for single filers is $14,600 and $29,200 for joint filers.

Itemizing your deductions allows you to claim qualified deductions individually — like medical expenses, donations and mortgage interest, etc. — but while that may save you a few extra bucks, it won’t take any stress out of your taxes.

Sponsored

Follow These Steps if you Want to Retire Early

Secure your financial future with a tailored plan to maximize investments, navigate taxes, and retire comfortably.

Zoe Financial is an online platform that can match you with a network of vetted fiduciary advisors who are evaluated based on their credentials, education, experience, and pricing. The best part? - there is no fee to find an advisor.